Photo by Yan Krukov on Pexels

05-21-2021 – Eric Fernwood

We’ve received a few queries recently concerning the potential for a wave of foreclosures in Las Vegas. In this article, I will share what we know and provide my opinion.

The Current Situation

Below are all single family properties on the MLS today for the Las Vegas Metro area.

- Foreclosure commenced: 5 properties

- Short sale: 4 properties

- Bank owned (REO): 4 properties

So the number of distressed properties are minuscule. What about properties that will potentially go into foreclosure in the future?

Extremely Low Inventory

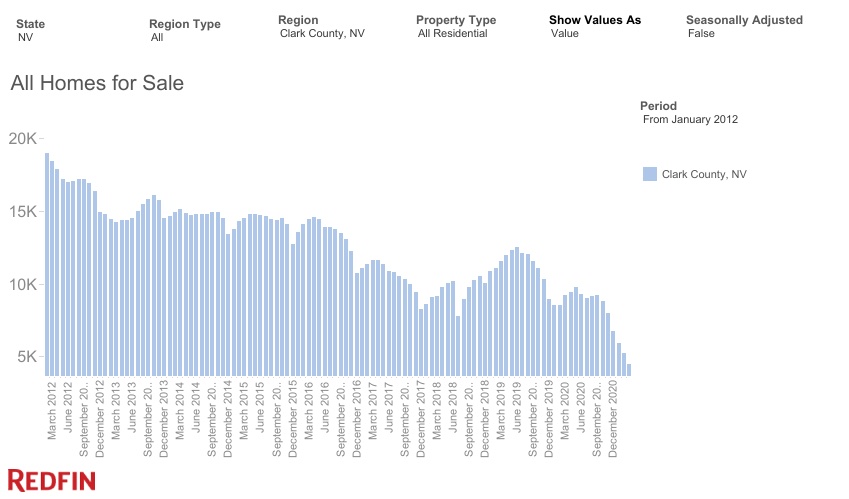

In 2008, almost every property in Las Vegas was underwater, plus we had 90 (ninety) months of inventory. Below is a chart from Redfin showing Las Vegas metro inventory from 2012 through March 2021.

As you can see, today the inventory is extremely low. A “balanced” market is 6 months supply. Today we are at less than one month of supply. So, even if a significant number of properties came on the market I do not believe it would make much of a dent in prices.

Home Equity Level

“Las Vegas has the highest unemployment rate at 14.8%, but Las Vegas homeowners have plenty of equity with an average loan-to-value ratio of 67.9%. As a result, many Las Vegas homeowners are tapping their home equity and downsizing. New listings are up 6.9% from last year, but for every seller there are buyers moving in, which has kept the housing market strong—home sales are up 9.3% from last year.” – PR Newswire dated Dec 07, 2020.

My Opinion

In December 2020, the loan to value ratio was 67.9%, so relatively few properties were underwater. YoY appreciation for properties that conform to our property profile was about 16%. The high rate of appreciation combined with the already low loan-to-value ratio means that even fewer properties are underwater. So, in almost all cases, if someone cannot pay their mortgage, they will sell the property, pocket the profit, and buy a smaller property or rent.

What powers an economy is jobs. Currently, there is $24B under construction with several large employers about to start operations, requiring more employees. And Las Vegas is reopening, so there is an increasing demand for workers. Likely, Las Vegas will fully reopen in weeks. I expect the economy of Las Vegas to improve significantly in the coming months. People who are having mortgage problems today are likely to be employed soon. Also, in normal times it takes over six months to foreclose. With all the COVID exceptions and modifications, it will likely take much longer than six months. So, I think most people will catch up and not need to sell. The result will be very little incremental inventory coming on the market.

In summary:

- There is very limited inventory. This is primarily driven by people fleeing high cost states such as California plus the creation of new Las Vegas jobs.

- Very few properties are underwater. So, if people have problems, they will sell the property, pocket the profit, and move on.

- Las Vegas is opening up, and thousands of additional jobs are being created.

At this time, I see the likelihood of any significant impact on prices due to foreclosures to be improbable. Instead, you can do what we did, buy another cash-flowing investment property and ride with the appreciation.