[Image generated with Dall-E]

Is multi-family always the right answer? It depends, as you will learn in this article.

The goal of real estate investing isn’t to own a particular type of property but to secure a reliable income. The reliability of this income doesn’t depend on the property type but on the tenant who occupies the property.

To show you what I mean, I will compare the financial performance of a typical 4-plex in Las Vegas to the typical properties we target over a 10-year period.

Typical 4-Plex Characteristics

Note: The property cost and rent came from averaging the 36 4-plexes for sale today (01/31/2024). The typical in-between tenant renovation cost came from property managers who specialize in multi-family properties.

Almost all 4-plexes in Las Vegas were built before 1986 and are located in distressed areas. The typical tenant stays less than one year, and the time to renovate and re-rent is three months. The typical cost for the in-between tenant renovation is $2,000. The typical unit rent is $800-$900/Mo. The typical cost for a 4-plex in reasonable condition is $650,000 – $700,000.

Assuming a one-year tenant stay, the unit is vacant three months out of every fifteen months. Assuming a higher-end $900/Mo rent:

- Gross 10-year rent: $900 x 4 units x 12 Mo x 10 Yrs = $432,000

- Lost Rent due to vacancy: Gross 10-year rent x (3 Mo Vacant / 15 Mos) ≈ $86,400

- Number of tenant turns per unit over 10 years: 10 Yrs / 15 Mos = 8 turns/unit.

- The number of tenant turns over 10 years for the 4-plex: 8 turns/unit x 4 units ≈ 32 turns

- Renovation cost for 32 turns: $2,000/turn x 32 turns = $64,000

- I will ignore all other costs to keep the example simple.

- Net 10-year rent: $432,000 – $86,400 – $64,000 = $281,600

Our Single Family Target Property Characteristics

Out of our population of over 490 properties, the average tenant stays for more than five years. The typical in-between tenant renovation cost is $500. (The low turn cost is due to Las Vegas pro-landlord lease agreements and the tenant segment we target.) The time to renovate and re-rent is one month. For the property segment we target, $700,000 can get you two properties. The typical rent for such a property is $1,800-$1900/Mo. I will assuming $1850/Mo rent for the example.

- Gross 10-year rent: $1,850 x 2 units x 12 Mo x 10 Yrs = $444,000

- Lost Rent due to vacancy: Gross 10-year rent x (1 Mo Vacant / (5 Yrs x 12 Mos)) ≈ $7,400

- The number of tenant turns over 10 years for the 2 units: 2 turns x 2 units = 4 turns

- Renovation cost for 4 turns: ≈ 4 turns x $500/turn = $2,000

- I will ignore all other costs to keep the example simple.

- Net 10-year rent: $444,000 – $7,400 – $2,000 = $434,600

The net rent from the fourplex over a 10-year period is significantly lower than that from two single-family homes. This is due to shorter tenant stays, longer vacancies, and higher turnover/repair costs.

Other Considerations

- Low income reliability: The tenant segment that occupies 4-plexes in Las Vegas is near minimum wage workers. They are typically the first to be laid off and the last to be rehired during economic downturns. During the 2008 financial crash, many multi-family properties were vacant and boarded up. Many were foreclosed upon. Our clients had zero decrease in rent and zero vacancies during the same period. The difference was due to the different tenant segments the properties attracted.

- Limited rent growth: Because near minimum-wage workers occupy multi-family properties in Las Vegas, the rent is tied to the minimum wage, which is currently $12/hour. So, you have limited ability to increase the rent unless the minimum wage increases. If you were to upgrade the units in an attempt to increase rents, it would not be effective. Individuals who can afford higher rents typically do not choose to live in distressed areas.

- Inability to screen out bad tenants: The people who occupy multi-family homes in Las Vegas typically live cash-based lives. Because they live cash-based lives, there is little financial history upon which to evaluate them for payment performance. According to one property manager, any financial history they have is likely to be bad. A property manager’s screening process for cash-based tenants: “If they have two pay stubs and enough cash to pay one month’s rent, they are in.”

- Leases mean little to cash-based tenants: Minimum wage workers tend to have few possessions, so if there is an issue, they put their possessions on the back of a pickup and go down the street to the next property.

Conclusion

The type of property is irrelevant. Your goal is not to buy properties that conform to others’ dogma. Purchase properties that best enables you to achieve your financial goals.

The right property type attracts a tenant segment with a high concentration of reliable tenants. A reliable tenant stays for many years, always pays the rent, and takes good care of the property.

In Las Vegas, the tenant segment with the highest concentration of reliable tenants is families with elementary-school-aged children with gross annual incomes between $60,000 and $85,000. Properties that attract this segment meet the following:

- Type: Single-family

- Configuration: 3 to 4 bedrooms, 2 to 3 baths, 2 to 3 car garage, one or two stories, 1,200 to 2,100 SF, with a lot size >3,000 SF and a full-length driveway.

- Location: Within multiple areas where the target tenant segment already rents.

- Rent range: $1,600/Mo to $2,100/Mo.

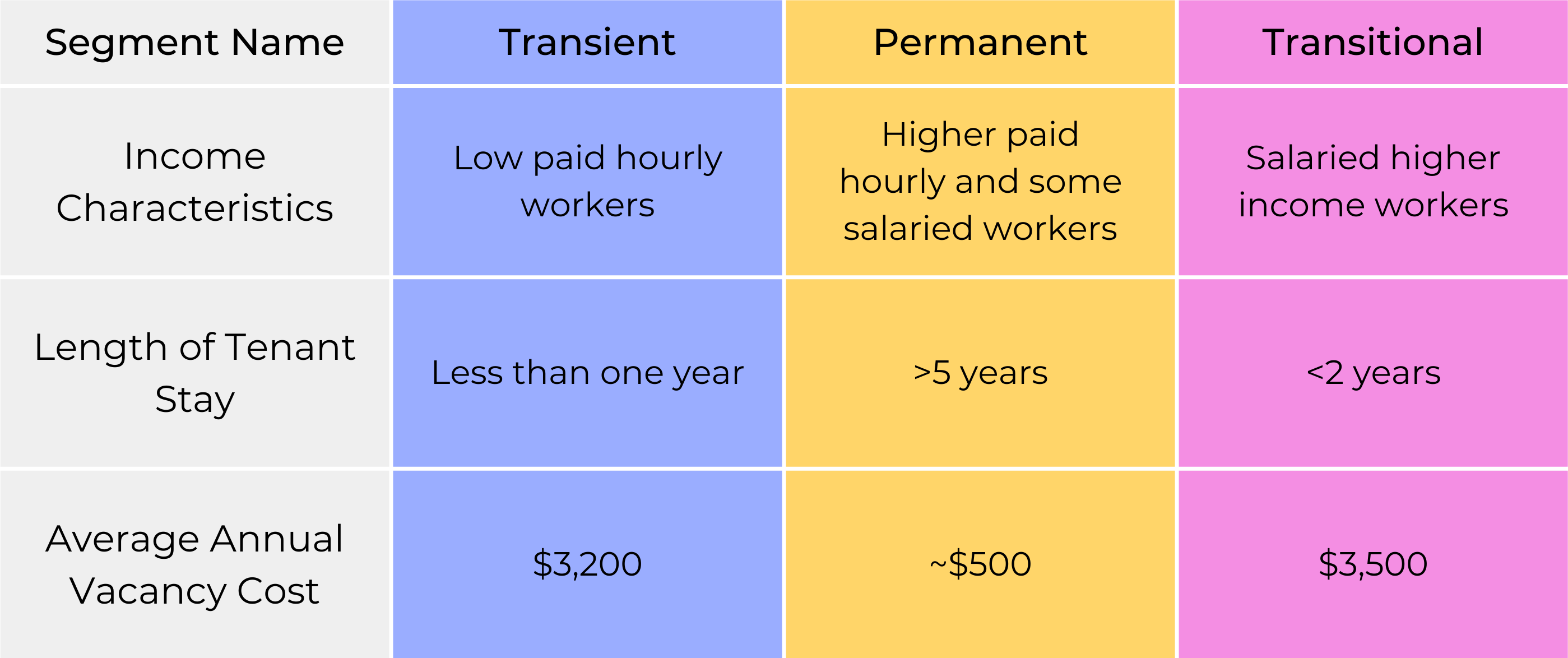

Could you do as well with other segments? No, because the other tenant segments do not perform as well. Some background on Las Vegas tenant segments.

There are three major tenant segments in Las Vegas, described below.

As you can see, the average yearly vacancy cost varies significantly between segments. You cannot afford to purchase a property that attracts a segment with high annual vacancy rates.

Real estate investing is a business. All decisions must be made based on your financial goal, not the dogma of others.