Accurate rent estimation is crucial for real estate investing, as it determines a property’s viability. To ensure accuracy, we evaluate each property’s rent three to four times, as detailed below.

First Estimate: Our Proprietary Software

The Investor Tool—our proprietary software that analyzes thousands of market properties to identify potential investment opportunities—generates rent estimates using data from recently rented properties, similar to websites like Zillow, Rentometer, and Redfin. However, the accuracy of rent estimates is limited.

Many people mistakenly believe that sites like Zillow and Rentometer (or any such software) can provide reliable rental prices. However, algorithms have significant limitations. For instance, when I checked a fire-damaged property at 3528 Oberon Lane, North Las Vegas, NV 89032, the software estimated rents between $1,900 and $2,200 per month—yet the property was completely unrentable in its current condition. This shows that software cannot accurately assess a property’s current condition.

Another example of software rent estimates failing is the property marked on the map below. The Zillow rent estimate for the property is $2,085/Mo. I was in this house several years ago. The noise from I-15 was so loud that my client and I had to shout to hear each other. Due to the noise, this property is practically unrentable.

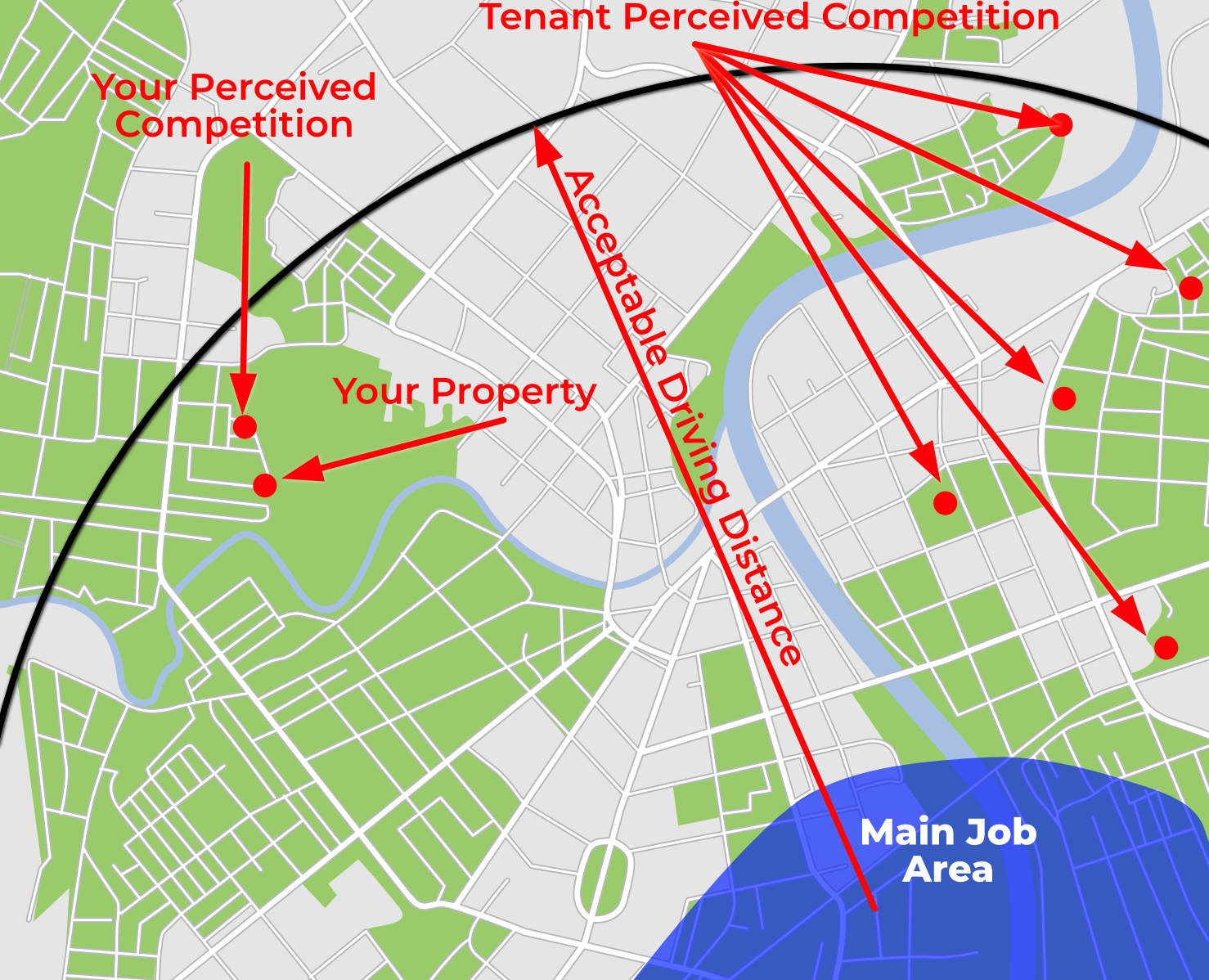

Another failure in all software (including ours) is that only similar properties near the subject property are considered. Reality is very different.

When people search for a place to live, they don’t restrict themselves to a specific area. Instead, they choose the location based on commute time to their workplace. Tenants consider any property that meets their housing requirements, regardless of location. This means a property across town could be your direct competition, not just the property down the street.

In summary, software-based rental estimates only provide rough approximations that may not reflect actual market rents. Therefore, we implemented a multiple-step process to increase rent estimate accuracy.

Second Estimate: Manual Evaluation

Properties that meet our client’s financial criteria undergo manual evaluation. This step is essential because software cannot evaluate critical factors—poor floor plans, nearby nuisances, lessons from past experiences, or accurate property conditions from photos. Only an experienced professional can make these crucial assessments. During this rigorous evaluation, we reject about 60% of properties.

Third Estimate: Onsite Evaluation and Property Manager Opinion

For properties that pass the manual evaluation, we perform an onsite inspection. If the property remains promising, we record a video walkthrough and send it to the property manager. To ensure an unbiased opinion from the property manager, we only provide the property manager with the MLS number and our walkthrough video. This ensures the property manager bases their evaluation solely on market conditions, the property’s condition, and their professional experience. The property manager‘s information includes the expected rent range, estimated time to secure a tenant, and any necessary renovations based on current market competition.

Fourth Estimate: Final Review Before Listing

Market conditions fluctuate as properties enter and leave the rental market. So, just before listing a property, the property manager performs a final rent evaluation based on current competition. This assessment provides the most accurate estimate and ensures our pricing stays competitive and current.

Summary

Software can provide rough rental estimates based on historical data, but it is not sufficiently accurate to make investment decisions. That’s why we’ve implemented a multi-step rent evaluation process that accurately reflects current market conditions and delivers the most reliable rent estimates possible.