[Image generated with Dall-E]

The goal of real estate investing is to acquire enough passive income to break free from the daily grind of traditional employment. To generate sufficient passive income, you’ll need to own multiple properties. In this post, I’ll show you how to acquire multiple properties with the least capital investment.

Buying in a Low-Appreciation Market

The most common method for acquiring multiple properties in low-cost markets is illustrated below. The example assumes: each property costs $250,000, you put down 25%, and you need 8 properties to replace your current income. The total capital required for the eight down payments is $500,000 (8 x $62,500). However, there is a problem. Inflation.

Inflation

Why are prices in a location low? Because for many years, there has been limited demand for housing so prices did not rise. Prices and rents are tied together. If prices are not rising, neither will rents. Why? In a low-cost market, more people can afford to buy as opposed to renting. The result is low demand for rental properties so rents increase slowly or may even decline.

As an example, suppose the 8 rental properties generate $5,000/Mo in the first year. If the inflation rate is 5% and prices and rents are increasing by 1% per year, your inflation-adjusted monthly income is decreasing by 4% per year.

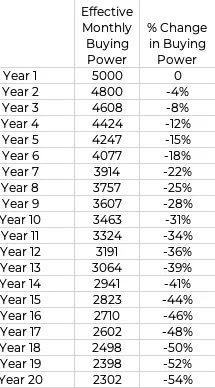

An example will clarify the problem. What is the loss in buying power over the next 20 years? See the table below.

Each year, you either have to reduce your standard of living by 4%, or get back on the treadmill.

The bottom line is that if rents don’t keep pace with inflation, you’ll end up back on the treadmill no matter how many properties you buy. This situation is likely to occur when your earning potential is far less than it is today, which could be during your retirement years. It’s an unfortunate situation to face.

Buying in a High Appreciation Market

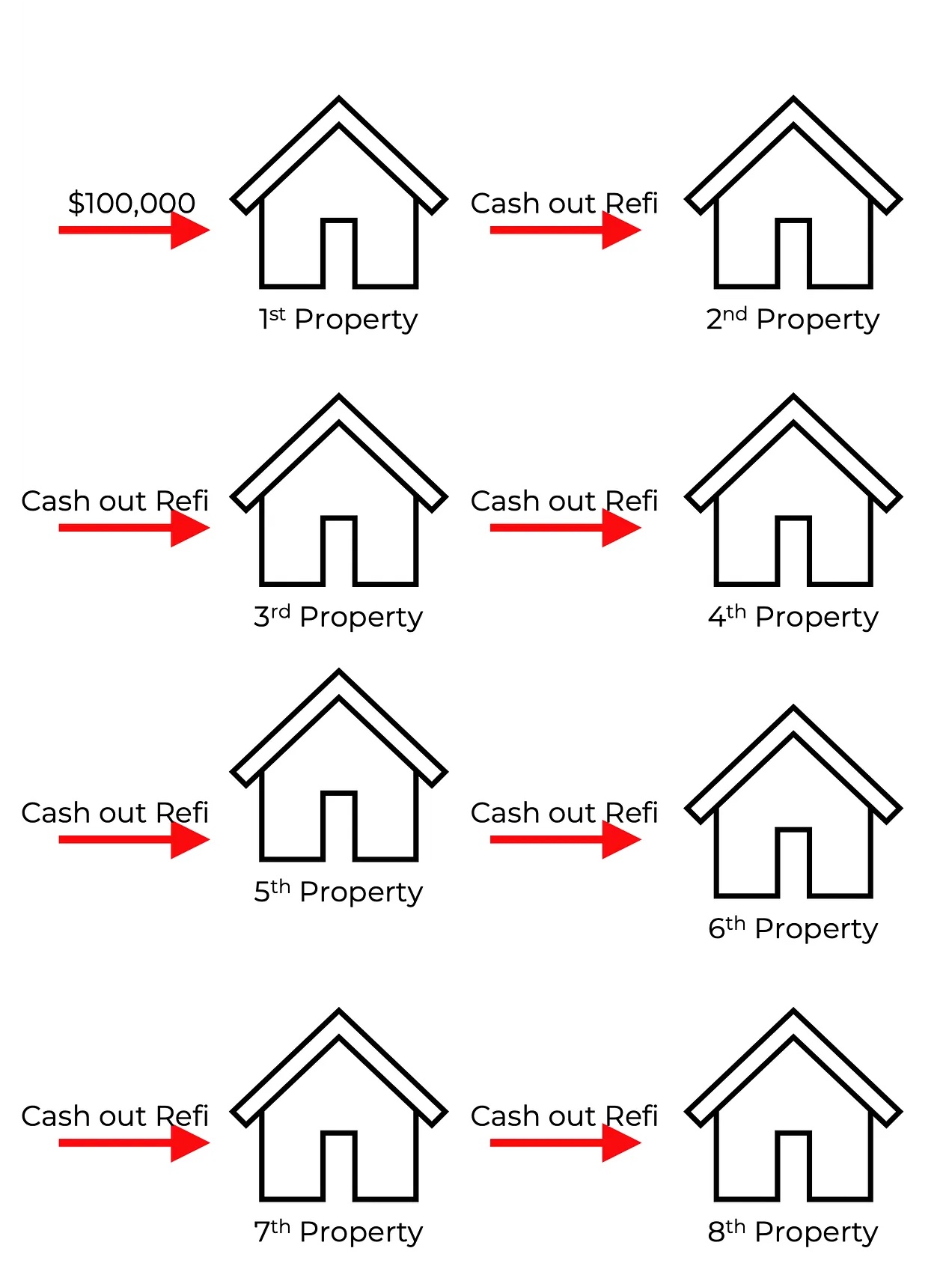

Buying in a high-appreciation market not only reduces your total down payment cost but also allows you to avoid the treadmill of constantly saving up for a down payment. See the image below. For this example, I assumed that the cost of properties in a higher-cost market will be $400,000. Prices in high-demand markets will be higher than in low-demand markets.

Using cash-out refinancing, the total cash needed to buy 8 properties is $100,000 compared to $500,000 in the low-cost market due to appreciation. In a high appreciation market, every few years you use a cash-out refi for the down payment on your next property. Is this realistic? Yes. I and our clients have been doing this for years in Las Vegas. Between 2013 through the first quarter of 2022, the property segment we target had an average annual appreciation rate of >15%. And, annual rent increases were >8%.

However, remember that we are only talking about the down payment. Whether you buy in a low or high-appreciation market, there will be additional costs including renovation and closing costs.

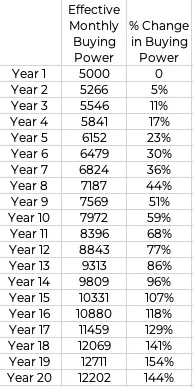

Below is a table showing the change in buying power over a 20-year period, assuming that rents increased by 8% per year while inflation averaged 2.68% (the average inflation rate for the last 20 years). This table illustrates the impact on your buying power over that period.

Over the 20-year period, buying power increased by 144%, including subtracting the average inflation. Additionally, it took far less money to buy the 8 properties due to cash-out refi than it did in a low-cost market where all investment funds came from your savings.

Summarizing

Low-Cost Markets

Buying in a low-cost market requires far more capital because all investment dollars must come from your savings. Additionally, low-cost properties are inexpensive because there has been little appreciation and rent growth for several years. So, even after you acquire enough properties to replace your current income, the buying power will decline every year, and sooner or later, you will be back on the treadmill.

Higher Cost Markets

Higher cost markets enable you to use cash-out refi to buy additional properties. And, because your rental income will increase faster than inflation, you stay off the treadmill.

This is why higher-cost markets require far less capital to achieve financial independence than low-cost markets.