[Image generated with Dall-E]

Flipping houses can be a great way to make or lose money. It all depends on selling the renovated property at the expected price, within the expected time frame, completing the renovation on time and on budget, and buying the property at the right price.

Profit/Loss Considerations

I often come across posts about how profitable flipping houses can be. However, I personally see flipping success as being similar to gambling in Las Vegas. You rarely hear about someone losing everything in Las Vegas. Instead, you only hear about the people who made money. I believe the same principle applies to flipping houses. Individuals without experience are almost certain to lose money.

Some important considerations.

- Renovation cost: You want to spend the least amount of money necessary to bring the property to the condition of similar properties that recently sold. For example, if recent sales had vinyl flooring in the kitchen, that is what you should install. Installing tile may make the property sell faster, but it is unlikely to increase the sale price significantly. If similar properties have tile and you install vinyl, the property may take longer to sell and could sell for less than those with tile. Therefore, do your research and be aware of what is considered market-ready for the price range and location you are considering. The basic process for determining what to renovate is illustrated below.

-

Realistic sale price: People often overestimate the value of their property. The value of a property is determined by what someone is willing to pay for it, which is based on the competition (or lack of it). Don’t be overly optimistic; be realistic. An accurate sale price is critical.

-

Getting work done: We’ve renovated more than 500 properties, and finding reliable tradespeople has been a struggle. Initially, we used licensed contractors, but they were expensive and the quality of work was often subpar. On top of that, they rarely adhered to the timeline agreed upon in the contract. Fortunately, we found a handyman of great integrity and helped him build his own handyman business. We still use licensed contractors when necessary, but the handyman’s team does most of the renovation work for about a third of the cost, and with excellent quality.

-

Project manager: We have a dedicated team member who manages all renovations. She visits sites every other day and records a progress video for the client. She has had years of training and verifies that the work is done correctly. Without an experienced manager, the project would cost more, take longer, and the quality would be lower.

-

Time frames: Every day you keep the property costs money. You need to estimate how long each step of the process will take, including the time it takes to sell. Be realistic and expect some delays.

-

Renovation risk: Renovation items such as foundation issues, mold, water damage, termites, etc., can make it difficult to determine the actual cost until you own the property and address the problem. It is important to be mindful of renovation risks.

Maximum You Can Pay

Below is the basic formula for determining the maximum price you can pay for a property:

- Maximum Purchase Price < Sale Price – Cost to Sell- Renovation Cost – Project Management Cost – Hold Period x Monthly Hold Cost – Closing Cost to buy – Profit – Pad

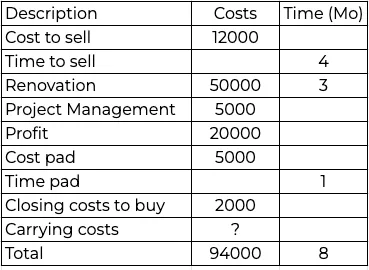

Below is an example showing how you would determine the maximum price you can pay for a property.

Cost/price components :

- Sales price and time: You’ve determined you can sell the property when it is in market-ready condition for $200,000. Also, it will take 3 months to go under contract and it will take one month to close. So, the hold period for selling the property is 4 months. I will assume that the cost of sales is 6%. So, 6% x $200,000 = $12,000.

- Renovation cost and time: You’ve done the necessary research and are confident that the renovation will cost less than $50,000 and will require less than 3 months.

- Project Management Cost: You found a person who will manage the renovation, schedule all work, go onsite every other day, and send progress videos for $5,000.

- Profit: Profit is also an expense. I will assume a profit goal of 10%. So, 10% x $200,000 = $20,000.

- Cost pad: There are always surprises, so you need to include a pad. The amount of the pad depends on the odds of significant additional costs. For example, if the renovation consists of well-defined costs like carpet, paint, appliances, and light fixtures, the pad can be small. If the renovation includes foundation issues, mold, water damage, etc., you need a larger pad. I will assume a $5,000 pad.

- Time pad: In the real world, little goes according to schedule. I will add a 1-month pad to cover unexpected delays.

Next, collect the costs and hold times.

If the probable sale price after renovation is $200,000 and the costs, not including carrying costs, are $94,000, I will assume that the maximum purchase price needs to be $100,000 or less for estimating carrying costs.

Carrying Cost

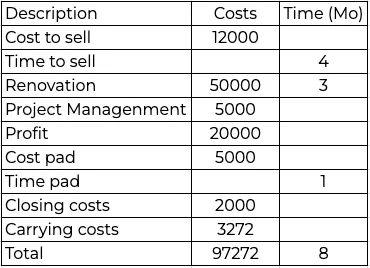

Many flip properties are not finance-able so I will assume the property was purchased with cash so there is no monthly debt service. And, I will assume the closing costs on the cash purchase were $2,000.

We can now estimate the monthly hold cost:

- Taxes: $1,400/Yr or $117/Mo

- Insurance: $800/Yr or $67/Mo.

- Utilities: $200/Mo

- HOA: $25/Mo

- Total: $409/Mo.

I estimated 8 months total hold time so my carrying cost is 8 x $409 ≈ $3,272.

Updating the cost list:

Based on our assumptions, we now know the maximum price we can pay for the property: $200,000 – $100,328 ≈ $99,672. If you pay any more, you are likely to lose money.

Summary

Flipping is a business that requires time and effort. Take the time to fully understand the property before making an offer. Do not assume that bidding low guarantees profitability. Some properties may cost more to renovate than their post-renovation market value.