Photo by Suntorn Somtong from Pexels

There is a proven method for estimating maintenance costs in the commercial world. The popular method of estimating maintenance cost by multiplying rent by an arbitrary constant is invalid and distorts estimated return. In this article, you will learn how to apply the commercial real estate methodology to residential properties.

The Percentage Method

A popular method for estimating maintenance cost is multiplying an arbitrary constant by the rent. So, the higher the rent, the higher the maintenance cost. The lower the rent, the lower the maintenance cost. This approach is invalid. There is no relationship between rent and maintenance cost, which you will see in the example below.

Below are two properties; the property on the left rents for $900 a month, and the property on the right rents for $1600 a month.

Due to the age and condition of the older property on the left, maintenance is approximately $2,000 per year. Due to the age and condition of the property on the right, the annual average maintenance is $350 per year. Let’s look at the most popular method of multiplying rent by a constant and see the results. I will use 5%, but I’ve seen numbers as high as 10% of the rent.

- Older property: $900 x 5% x 12 = $540/Yr.

- Newer property: $1,600 x 5% x 12 = $960/Yr.

As you can see, this popular method of using a percentage of rent fails for both the older and the newer property. Again, rent has no relationship to maintenance costs. I believe this recipe came about because they wanted to make estimating maintenance cost more simple than it is. Einstein said it very well.

Everything should be made as simple as possible, but no simpler. – Albert Einstein

Fortunately, there is a method that works well and has been used in the commercial world for decades.

A Property Specific Maintenance Provision

The method used in the commercial world is to determine a maintenance provision based on the remaining lives of major components. This method is both property specific and reasonably accurate. Notice the words “reasonably accurate.” The fact is that there is no way to know precisely when a component will fail. For example, water heaters typically last about 12 years in Las Vegas. Have I seen them fail at six years? Yes. Have I seen them last 18 or more years? Yes. The best you can do is to work off of national averages.

In Las Vegas, the two most common expensive components we deal with are the air conditioner compressor and the water heater. Below is a table showing the cost to replace the units and the useful life for each. The useful life comes from a national source. Note that in your location, you may have several more high-cost items. I will show you a method for provisioning base-level repairs a little later.

| Cost Item | Typical Cost (installed) | Useful Life (Yrs) |

|---|---|---|

| AC Compressor | $2,500 | 15 |

| Water Heater | $900 | 12 |

It is relatively easy to determine the age of the water heater. The manufacture date is stamped on the side of the unit. Note that some water heaters might sit in a warehouse for a year or even two before installation, so the date stamp is not precise, but it is usually the best we have. It is more difficult to determine years in service with an air conditioner. An air conditioner has many parts, and some may have been replaced. But a reasonable assumption is to work off the air conditioner manufactured date as well.

Below is the table where I assumed years in service and determined the remaining useful life.

| Cost Item | Current Years in Service |

Remaining Useful Life |

|---|---|---|

| AC Compressor | 4 | 11 |

| Water Heater | 9 | 3 |

Based on the remaining useful life, you can calculate the monthly provision for the AC compressor and the water heater as shown below.

- AC compressor: $2,500 / 11Yrs / 12Mo/Yr = $19/Mo.

- Water heater: $800 / 3 Yrs / 12Mo/Yr = $22/Mo.

The total maintenance provision for each month is: $19 + $22 or $41/Mo.

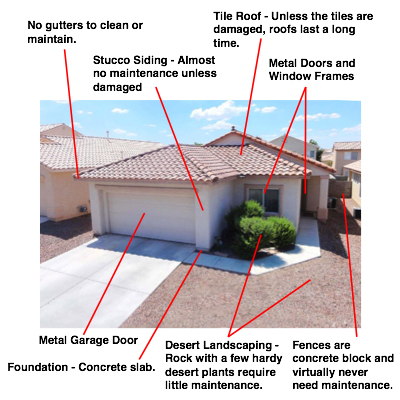

There is another maintenance cost component to consider, and that is what I call base level repairs. This is a catch-all category containing dripping faucets, slow draining sinks, etc. The best place to obtain the cost is the property manager. For the properties we deal with, the annual base maintenance cost is about $300 per year. Note that this is much lower than you would experience in other areas. This is largely due to the materials required to withstand the Mojave Desert and our process for cherry-picking low maintenance cost properties. See the image below.

Due to the construction materials, there’s not a lot to maintain. So, let’s include $300 a year into our maintenance provision.

- AC compressor: $2,500 / 11Yrs / 12Mo/Yr = $19/Mo.

- Water heater: $800 / 3 Yrs / 12Mo/Yr = $22/Mo.

- Base maintenance: $300/Yr / 12 Mo/Yr = $25/Mo.

The total for each month for this property is: $19 + $22 + $25 = $66/Mo.

What if you don’t know when the water heater or air conditioner went into service? You could assume that the major cost elements are halfway through their useful life. I will do the same example and assume that the components are halfway through their useful life.

- AC compressor: $2,500 / (15Yrs * 50%) / 12Mo/Yr = $28/Mo.

- Water heater: $800 / (12Yrs * 50%) / 12Mo/Yr = $11/Mo.

- Base maintenance: $300/Yr / 12 Mo/Yr = $25/Mo.

The total is $28 + $11 + $25 = $64/Mo. or $768/Yr.

In Conclusion

Maintenance cost has nothing to do with rent. The popular method of multiplying rent by a fixed constant to estimate maintenance is invalid. The method used in the commercial real estate world for decades makes a lot more sense to estimate a property-specific maintenance provision.