If you have followed my blogs for a while, you will know that we only target a narrow segment of properties in Las Vegas, because those attract a tenant segment with the highest percentage of high-performance tenants. This segment contains mostly single-family homes, as well as select townhome communities in highly desirable locations. A common question is whether townhomes, as investments, will perform as well as single-family homes. Out of the 100+ townhome communities in Las Vegas, we are aware of only a few that consistently perform well.

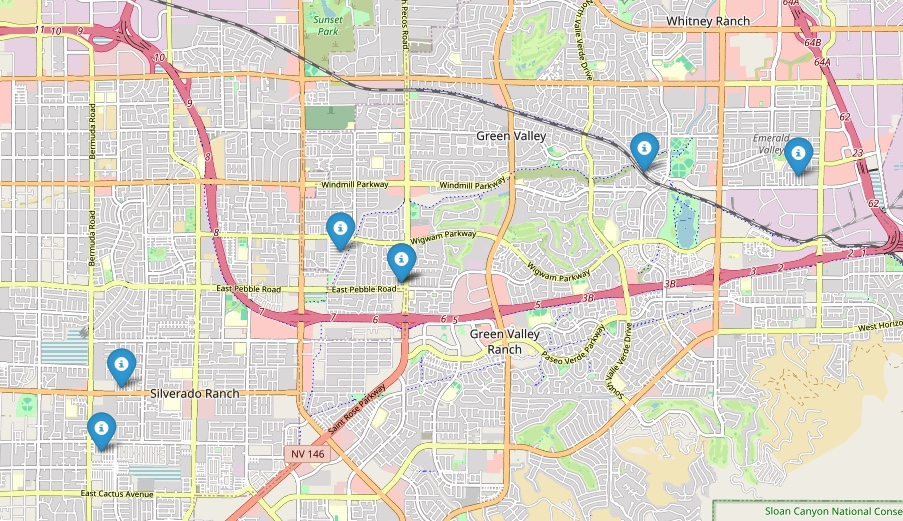

In this post, I extracted 10 years of sales and rental data from the MLS for six townhome communities located in Silverado Ranch and Green Valley, and examined the appreciation and rent growth rates for these properties. Below is a map showing the locations of these communities. There are more townhome communities we target, but these are representative.

These townhomes come in both 2- and 3-bedroom models. Each unit has a one-car garage with ample driveway space and plenty of street parking.

One of the reasons we like these townhomes is their price point. Today, you can purchase a two-bedroom unit for about $330,000 to $350,000, depending on condition and location. The HOA fees are reasonable at less than $120/Mo.

The tenant demographic is not the same as for the single-family homes we target. These units attract older couples and young couples. The average stay is 2 to 3 years.

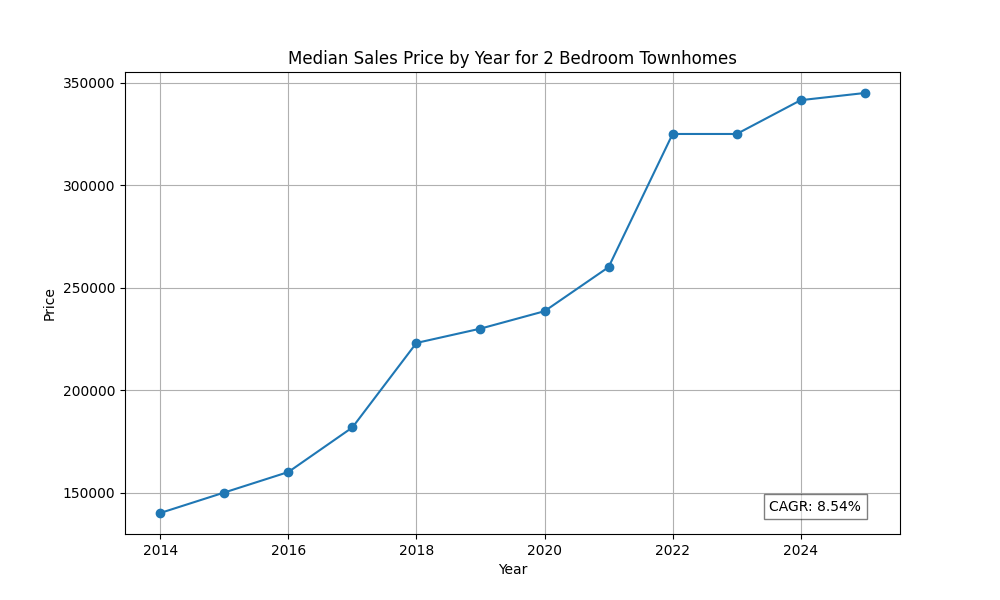

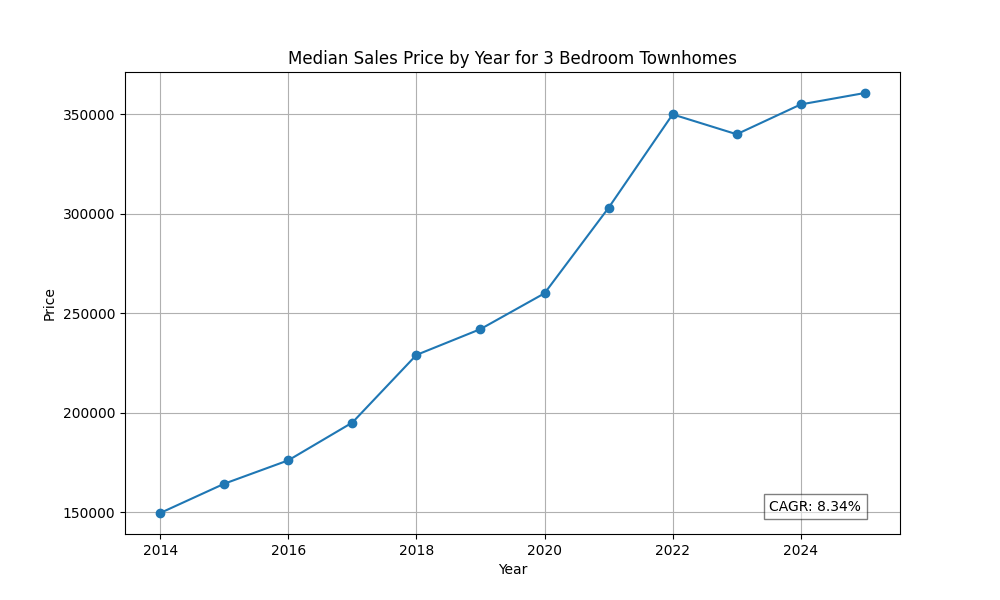

Below are charts illustrating the performance of these townhomes.

Appreciation

Median Sales Price by Year

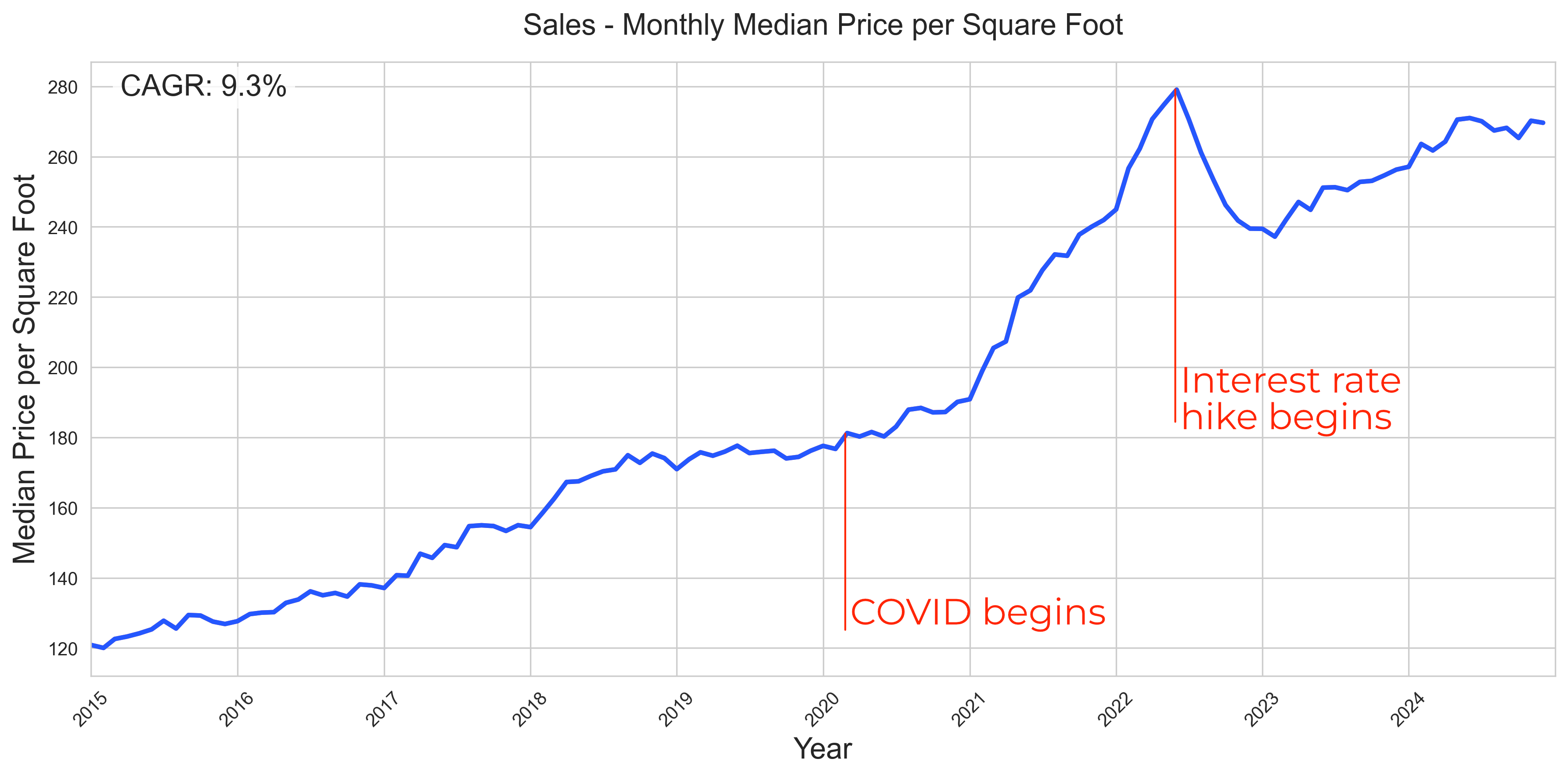

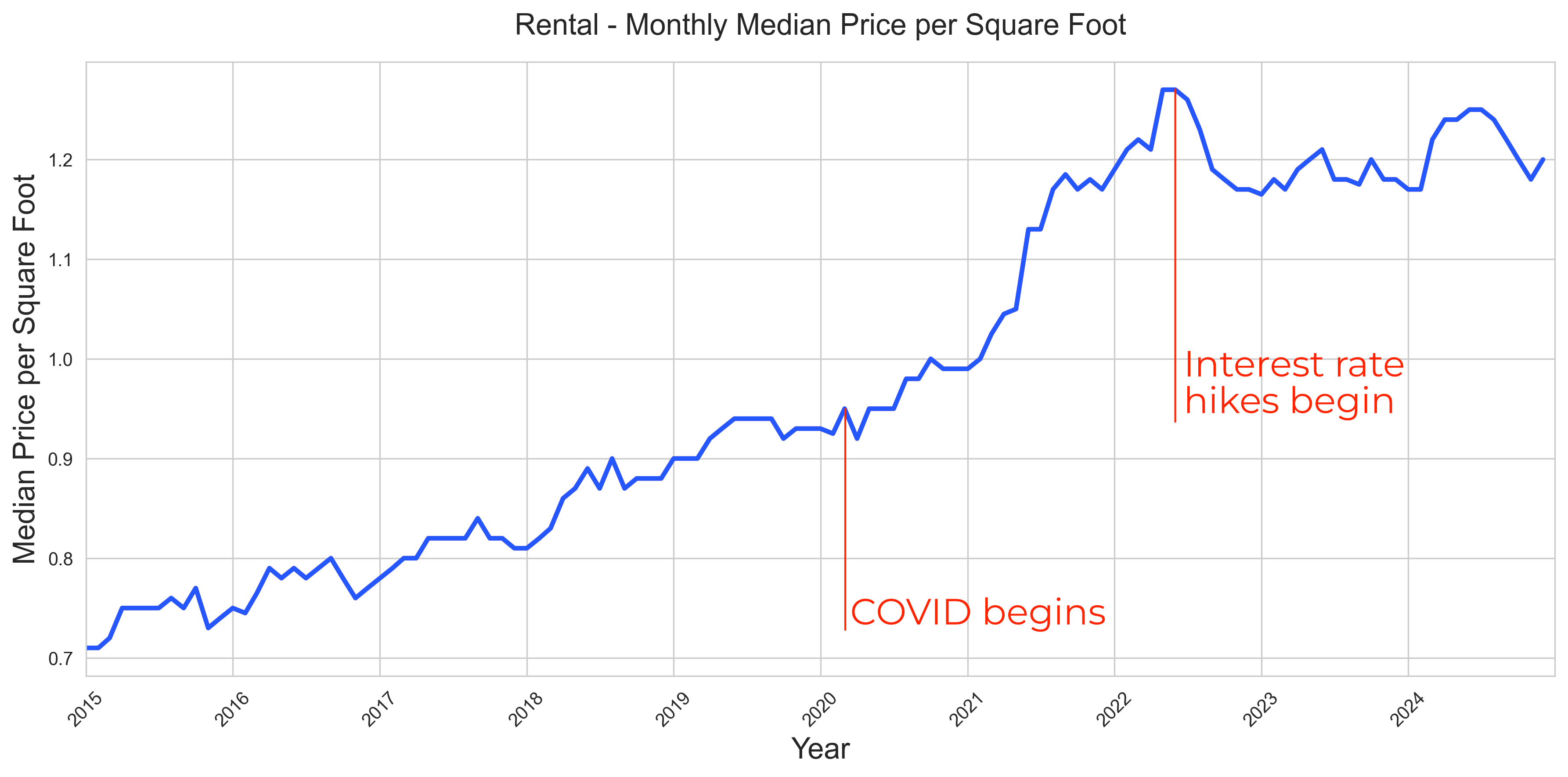

For comparison, below is the single-family home appreciation rate for our target property profile, as outlined in our 2025 Investor Outlook. We use the median price per square foot to track the appreciation rate of single-family homes.

The appreciation rate is very similar.

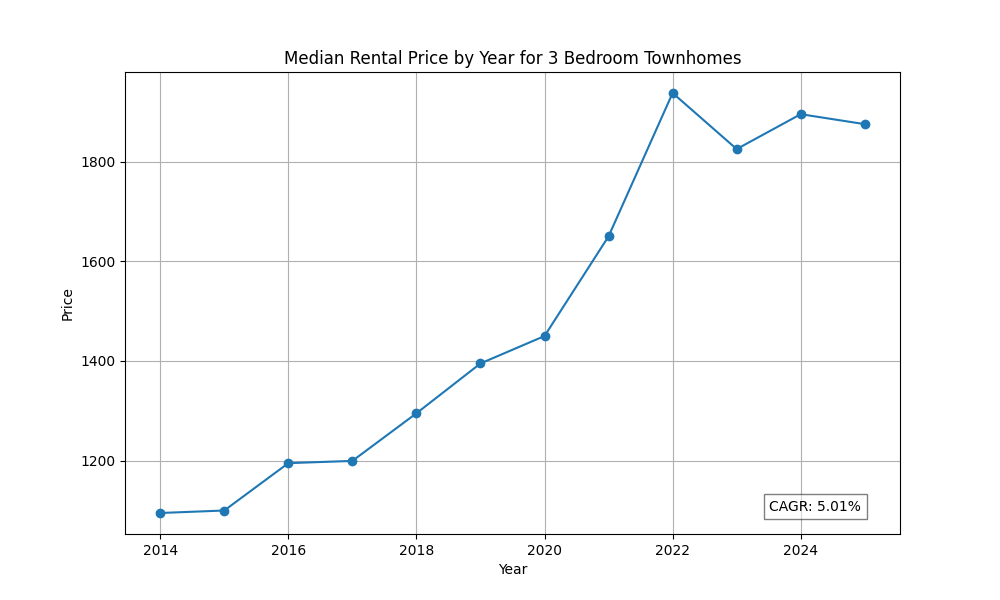

Rent Growth

Median Rental Rate by Year

As a comparison, below is the single-family home rent growth rate for our target property profile (from our 2025 Investor Outlook)

The rent growth rate is also similar.

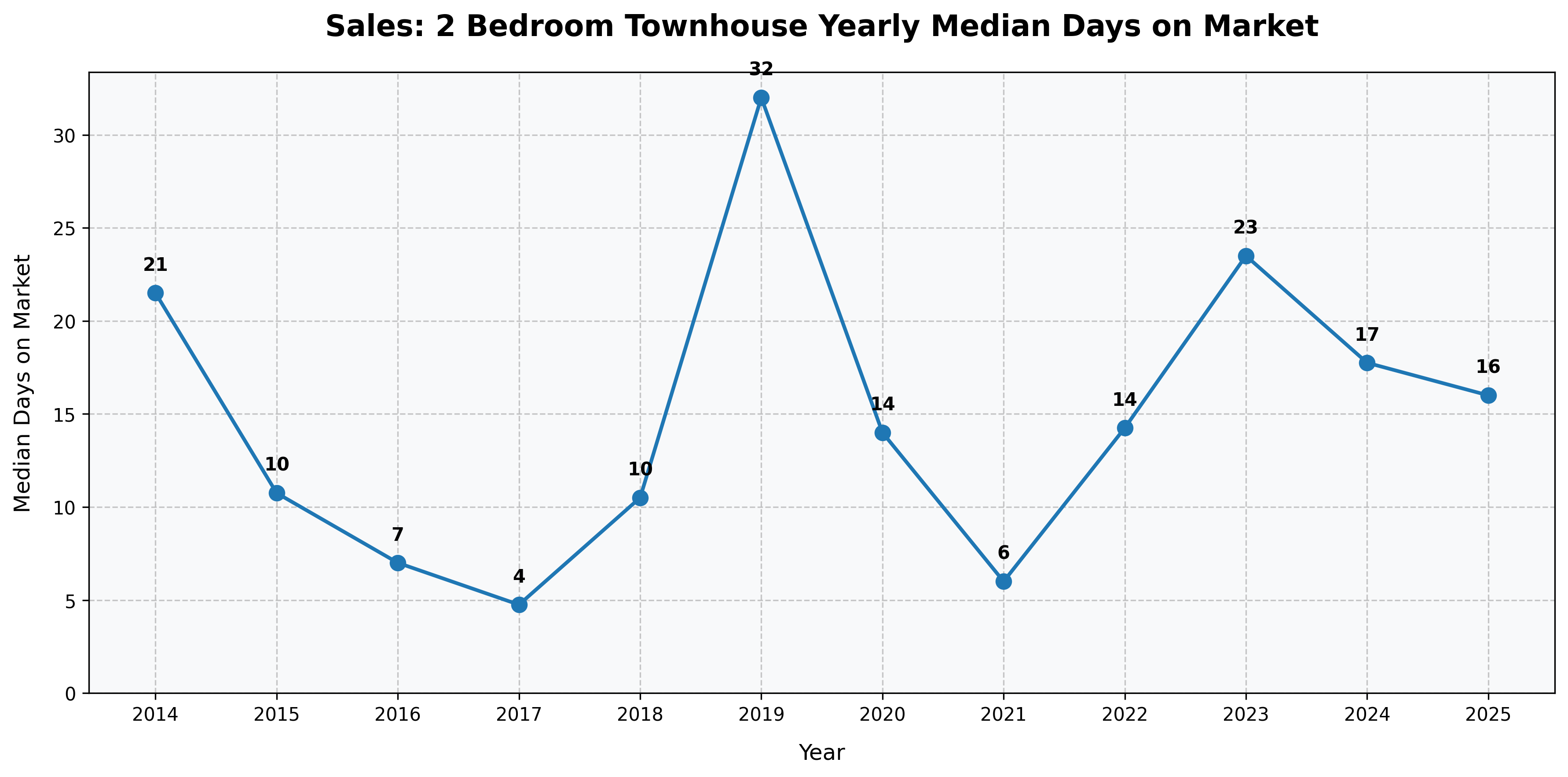

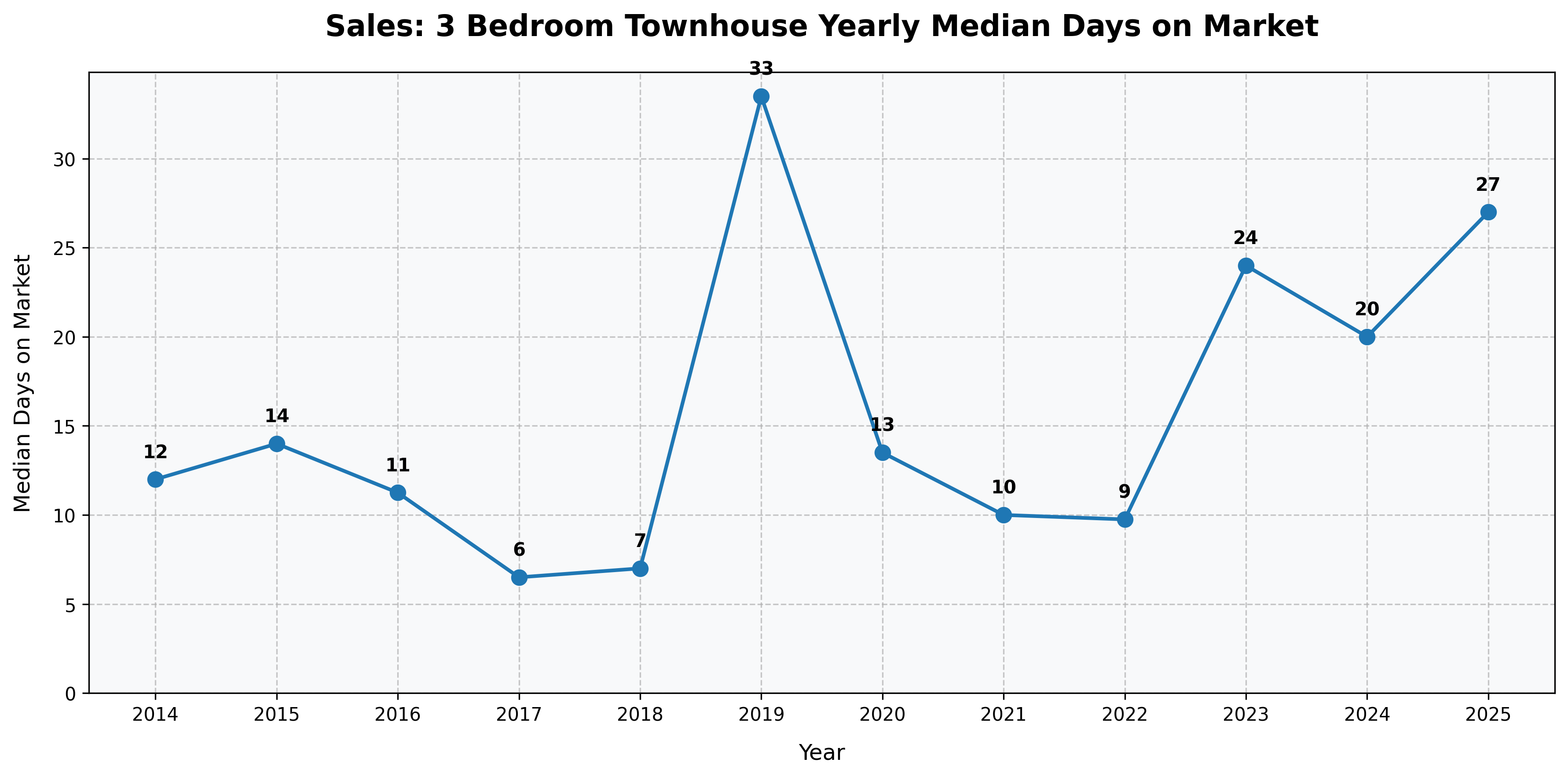

Desirability – Days on the Market

Sales Median Days on Market Per Year

Over the last 10 years, the median days on the market have consistently stayed under 30 days (except in 2019), indicating the high desirability of these units. We monitor these communities daily and regularly see overpriced units languish on the market, which extends the days on market statistics. Correctly priced units typically go under contract within days.

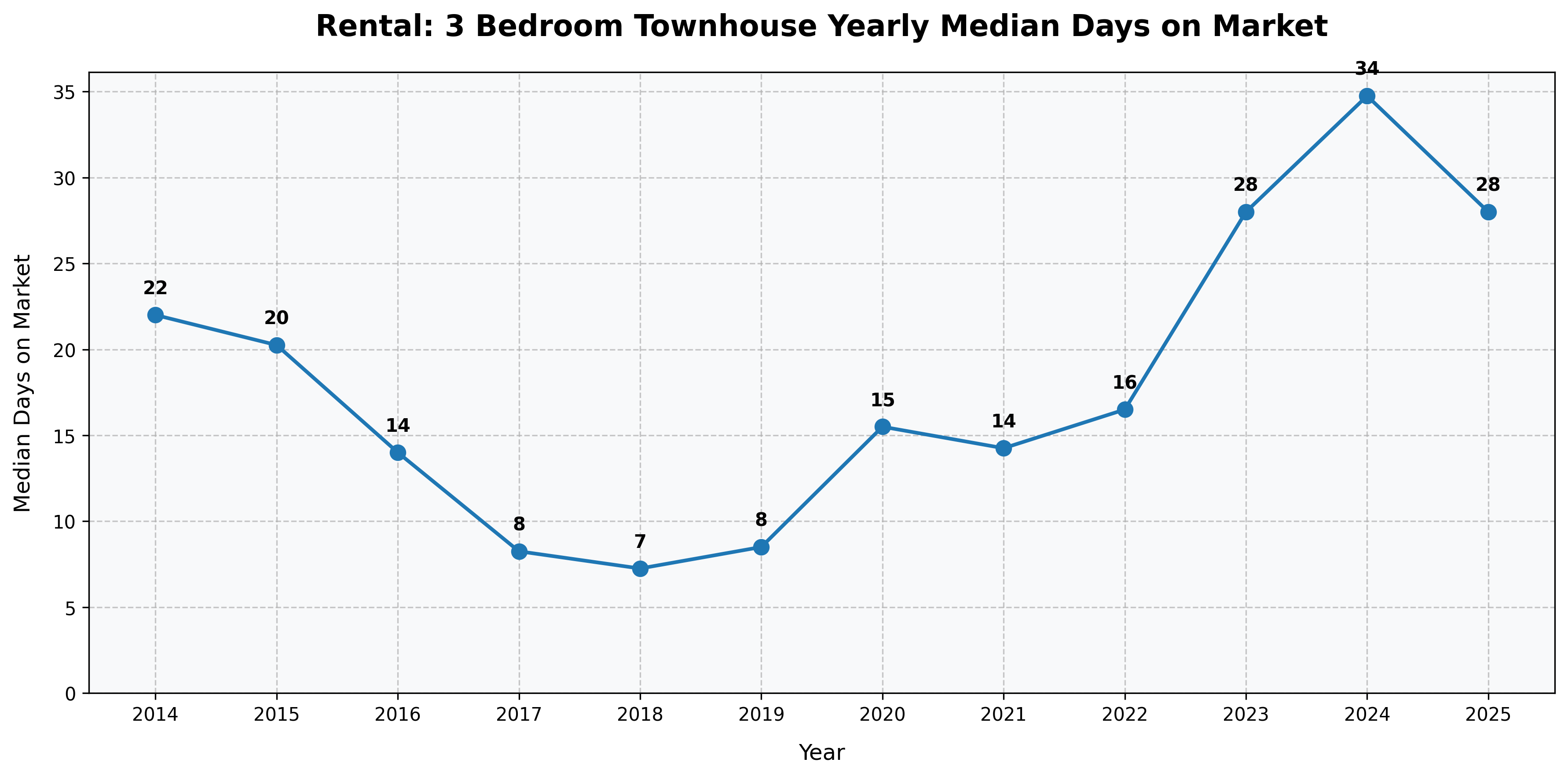

Rentals Median Days on Market Per Year

The median days to rent also remained under 30 days throughout the last decade (except for the 3-bed units in 2024), indicating the desirability of these units. If and when you encounter a vacancy, you can expect to fill your unit in a reasonable timeframe.

Conclusion

In terms of appreciation and rent growth, select townhomes we target perform just as well as single-family homes we target. And they have lower price points. These are excellent investment properties. If you have any questions regarding these townhomes (as investments), please feel free to reach out.