I’m often asked about investing in new builds for reduced maintenance costs. While this may be true for the first few years, the initial lower maintenance cost is the only advantage.

A Different Tenant Segment

For over 17 years, we’ve targeted tenants who earn between $60,000 and $90,000 annually and stay an average of five years. How much rent can they afford? People typically spend 30% of their gross household income on rent, so we can calculate the rent range based on annual income.

- ($60,000/Yr / 12Mo/Yr) x 30% = $1,500/Mo

- ($90,000/Yr / 12Mo/Yr) x 30% = $2,200/Mo

Today, this rent range corresponds to single-family properties priced between $350,000 and $475,000. The inventory of homes in this price range cannot be increased, largely due to land costs, which start at $1M per acre in desirable areas.

New single-family homes in desirable areas start at $550,000. Break-even rent for a $550,000 home (assuming 30-year, 25% down, 6.5% rate) is at least $3,100/Mo, which equates to an income of roughly $123,000/Yr ($123,000/12 x 30%). This is far higher than what our target segment earns.

People at this income level are typically home buyers, not renters. They rent only during major life transitions—relocation, divorce, loss of a spouse—and buy once life stabilizes. This is why the average stay for this segment is less than two years.

If you buy a new single-family home, the break-even rent is higher than what tenants who stay five or more years can afford. The short stay of people who can qualify for $3,100/month rent results in much higher vacancy costs.

Vacancy Cost

Vacancy cost is a function of how long the tenant stays in the property, carrying costs until a new tenant moves in, plus the cost to restore the property to rent-ready condition. To compare the vacancy cost difference between the two tenant segments, below is an estimate of the 10-year vacancy cost. Financing assumptions: 30% down, 6.5%, 30-year.

- $550,000: Tenant stays 2 years; between tenant renovation cost is $3,000; carrying cost is $3,000/Mo, it takes 3 months to renovate and get a tenant in the property (due to the much smaller pool of potential tenants at the required income level). Per vacancy cost: $3,000/Mo x 3 Mo + $3,000 = $12,000. With 5 turns in 10 years: $12,000 × 5 = $60,000 per ten years.

- $400,000: Tenant stays 5 years; between tenant renovation cost is $1,000, carrying cost is $2,200/Mo, it takes 2 months to renovate and get a tenant in the property (a much larger tenant pool who can afford this rent). Per vacancy cost calculation: $2,200/Mo x 2 Mo + $1,000 = $5,400. So, 2 turnovers in 10 years: $5,400 × 2 = $10,800 per ten years.

Due to higher costs, shorter tenant stays, and longer time to place a tenant, the vacancy cost difference over ten years is $49,920. This is a huge cost to reduce maintenance costs for a few years.

Income Reliability

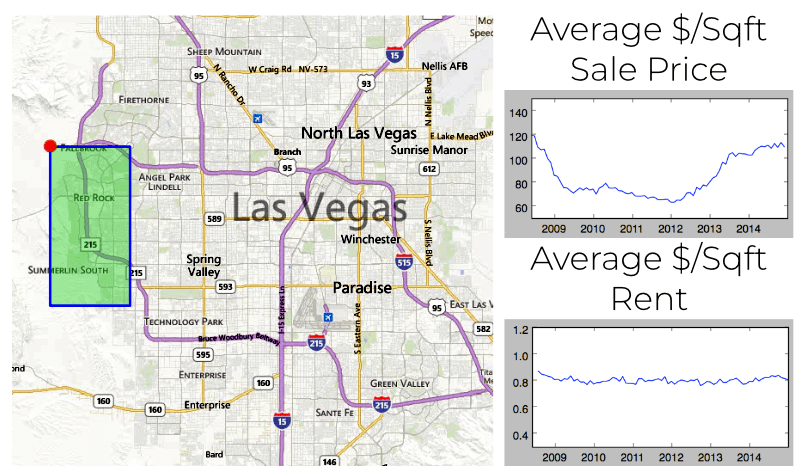

Income reliability is critical. The tenant segment we target primarily holds mission-critical, income-producing, or government jobs and is rarely laid off. During the 2008 financial crash, for example, our clients experienced no decrease in rent and no vacancies despite a 40% or greater decrease in market value, while thousands of lower- and higher-income workers lost their jobs. The illustration below shows an example Las Vegas area where prices collapsed but rental income remained stable for the properties and tenants we target.

Bottom line is that new single-family homes attract a segment much more likely to be laid off during economic downturns than the segment we target.

Maintenance Cost Savings

Maintenance cost is typically divided into two categories:

- Base maintenance: This includes dripping faucets, running toilets, a dishwasher door latch that doesn’t work properly, etc. For our properties, the five year average annual maintenance cost is about $400/Yr.

- High cost items: This includes air conditioners, water heaters, and roof repairs. Such costs are what some people provision for. Here is an article on how to estimate a property specific maintenance provision.

Do the maintenance cost savings of new homes actually result in cost savings? No. For example, if I assume the $550,000 new home has no maintenance cost for the first 5 years, and the average maintenance cost of a $400,000 home is $400/Yr. If I assume both properties are financed with 30% down, 30-year, 6.5% rate, the five year debt service is:

- $550,000 monthly debt service: $2,433/Mo. Five year cost: $2,433/Mo x 12 Mo/Yr x 5 = $145,980.

- $400,000 monthly debt service: $1,790/Mo. Five year cost: $1,790/Mo x 12 Mo/Yr x 5 = $107,400.

The difference in five-year debt service cost is $38,580. The assumed base maintenance cost for the $400,000 home is $400/Yr x 5 Yrs = $2,000. So the incremental cost for the new property is $38,580 – $2,000 = $36,580. This equates to:

- 4.5 roof replacements, assuming $8,000/Roof

- >24 water heater replacements, assuming $1,500/Water heater

- >14 AC compressor replacements, assuming $2,500/air compressor

- >5 complete HVAC replacements, assuming $7,000/HVAC

This is in addition to higher vacancy costs and higher property taxes. In summary, there are no cost savings.

The small maintenance cost savings are negligible compared to the much higher debt service.

Higher Property Taxes

New builds are taxed at ~1% of the sold price versus 0.55% for the property segment we target. What is the property tax difference?

- $550,000 x 1% = $5,500

- $400,000 x .55% = $2,200

The annual tax difference of $3,300 exceeds the cost of replacing two water heaters, one AC compressor, or half of a complete HVAC system, each year.

Location Disadvantage

New single-family homes priced less than $600,000 are outside the I215 loop, as you will see in the map below. I checked the prices of several new single-family home developments inside the 215 loop, and none were priced below $600,000. To my surprise, I even found subdivisions where prices started at over $1 million.

New home communities with properties priced near $550,000 are located in areas with limited infrastructure and low-capacity roads. The lack of high-capacity roads connecting these lower-priced new home developments results in long commute times to work. Home buyers are more willing to tolerate long commutes and limited infrastructure to get “started” in home ownership. But renters are unlikely to sacrifice convenience for a new build.

Conclusion

I found no advantages to new builds other than potential maintenance cost savings in the first few years. However, because everything else is far more expensive, you will have significantly lower cash flow, higher vacancy costs, and less reliable rental income. The reason for the lower cash flow includes:

- Higher debt service

- Higher property taxes

- Higher vacancy costs

- Lower income reliability in times of economic downturns

Get weekly insights like this and learn how professionals build income safely.