The stock market keeps closing at record highs. I started hearing people say, “maybe I should put money in the stock market now instead of buying real estate”.

I have talked about the comparison between stocks and real estate many times – they are completely different investment options. I will briefly summarize them here.

Stocks

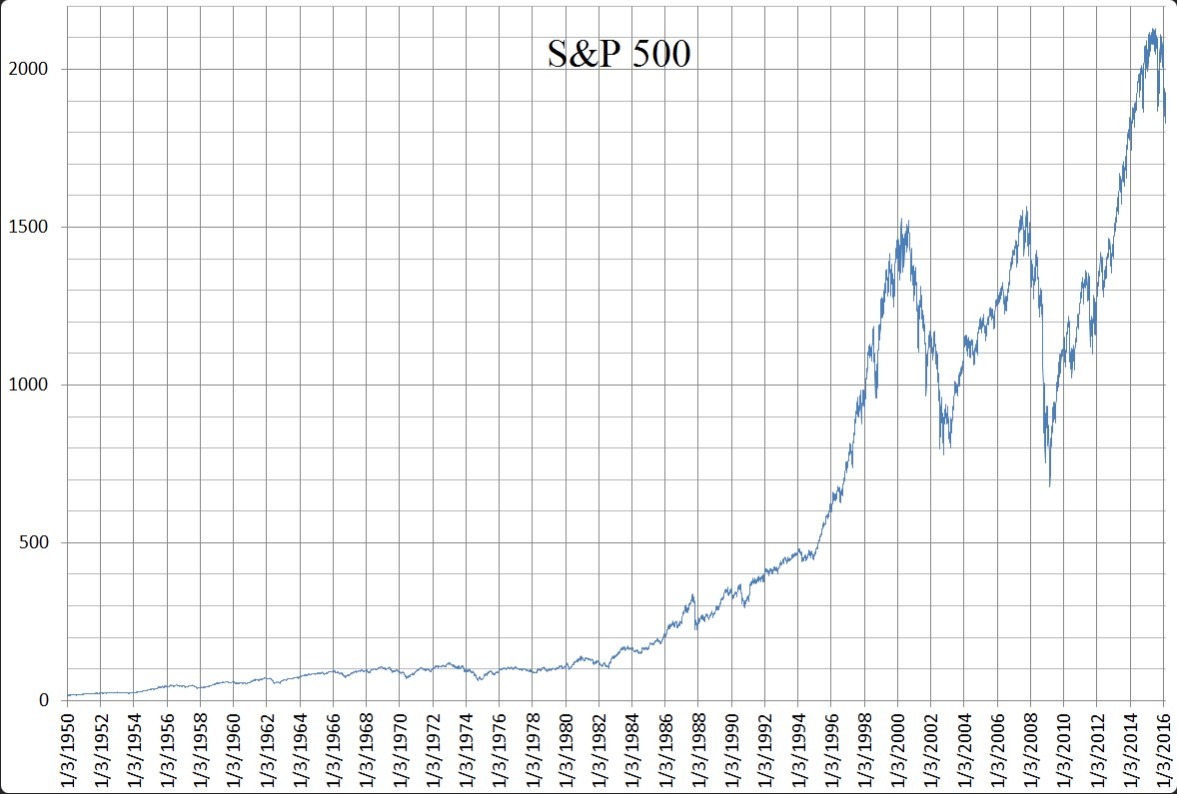

The track records of Dow and the S&P 500 show that stocks can work well for wealth accumulation, IF you stay in the market for decades through indexing or only buy stocks with great fundamentals (which can be a highly fallible process). Below is a chart showing the volatility of even the S&P 500 index.

[Source]

Where stocks are challenged is providing reliable income.

Suppose you only had stock investments, and you need $100,000/Yr in today’s dollars to maintain your lifestyle, and you expect 30 years of retirement. If there is zero inflation and no market crashes, you will need $3,000,000 (30 x $100,000). That is a lot of capital to acquire.

If we assume 5% inflation and no major market downturns, you’d need to save around $6.6 million before retiring. That’s a significant amount for anyone to accumulate. Depending on this nest egg to support $100,000 a year (in today’s dollars) over 30 years also assumes you’ll always pick the right stocks and avoid losses from inflation or market declines. Even top money managers find it extremely difficult to achieve this level of performance over a decade, let alone 30 years. This is why people move out of stocks when they need/want a reliable income for financial independence or retirement.

Real Estate

- “Ninety percent of all millionaires become so through owning real estate.” …Andrew Carnegie

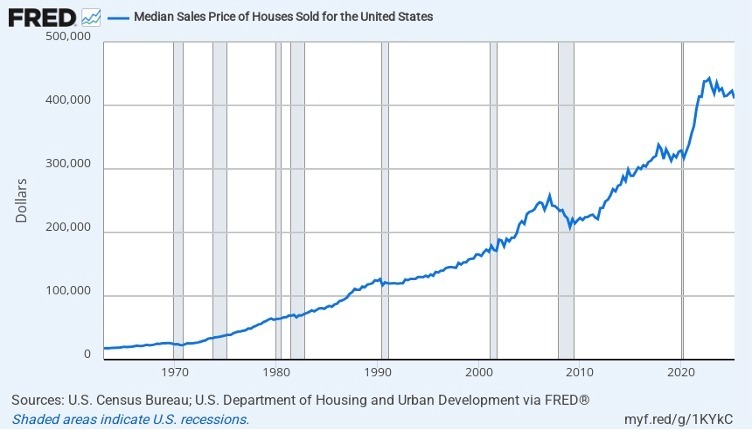

Track records also show that real estate can work very well for wealth creation. Below is a chart showing the median home sales price in the U.S. in the past 60 years. Although real estate markets are highly local, the concept is valid.

[Source]

More importantly, real estate can provide you with reliable and inflation-beating income, indefinitely, if you invest in the right market and target the right tenant segment.

Using the prior example, how many properties would you need to acquire for a $100,000/Yr income? Converting this to a monthly cash flow requirement: $100,000/Yr ≈ $8,333/Mo. If each property generates $2,000 per month and costs $400,000 to acquire (a typical scenario for our target property profile today). You would need 5 properties if you acquire them outright with cash. That’s 5 x $400,000 = $2,000,000. Still a lot of capital, however, you can utilize leverage (low-risk 30-year fixed rate) and accumulated equity to reach your portfolio size with far less capital. See here for the detailed math.

But it gets better. When you buy in the right city, you can expect rent growth (and price) to consistently outpace inflation. Assuming a 7%/Yr rent growth (how our property profile has performed since 2015), here’s what will happen to your purchasing power of that $100,000/Yr even with a 5%/Yr inflation:

- After 1 year: $100,000 x (1 + 7%)^1/(1 + 5%)^1 = $101,905

- After 5 years: $100,000 x (1 + 7%)^5/(1 + 5%)^5 = $109,894

- After 10 years: $100,000 x (1 + 7%)^10/(1 + 5%)^10 = $120,766

Your income increases. And this is income that you can pass on to your children and their children.

What about income reliability?

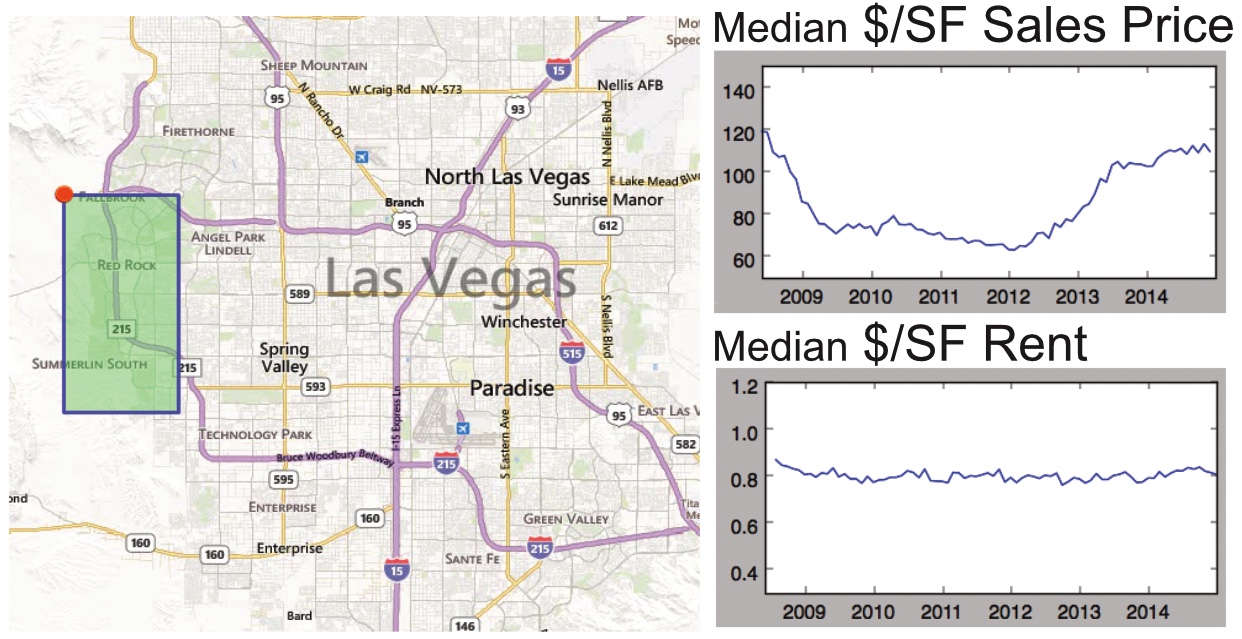

During the 2008 financial crash, even though property prices plunged, our clients had zero decrease in rent and zero vacancies (see the chart below).

Of course, real estate has its disadvantages. The biggest one is illiquidity. It is better suited for long-term holding or generational wealth.

Stocks and Real Estate Are Completely Different

They each have their strengths and weaknesses, and should not be used as replacements for each other. I strongly believe that a good investment portfolio should include both. The allocation between stocks and real estate is, of course, individual. However, whether you choose to allocate your equity 50% in stock and 50% real estate, or 60/40, stick to it. Do not chase trends and hop on or off whatever seems to be the latest “hot” investment (certain stock tickers, crypto, gold, etc.). Over the long run, I believe that investors with discipline and a focus on great fundamentals have the best chance of reaching their goals.

Is Now a Good Time to Buy Real Estate?

Q4 has traditionally been a favorable time for investors to purchase. Since fewer people want to move during the holidays, the sellers that remain on the market are likely motivated. This means more opportunities for better deals.

This year, the Las Vegas market experienced an unusual slowdown since early summer 2025, likely due to the psychological effects of the tariff chaos and global and domestic tensions. However, unlike many headlines may suggest, the fundamentals of the market remain unchanged. I will explain in more detail in our October Monthly Market Report. This makes this buying season even more attractive for investors who want to purchase in a growing market with solid fundamentals at a value price. In fact, we have already heard from multiple clients who recognize this opportunity and are getting their finances ready to purchase in Q4.

If you have been considering starting or adding to your portfolio, now may be a good time.

Get weekly insights like this and learn how professionals build income safely.