[Image generated with Dall-E]

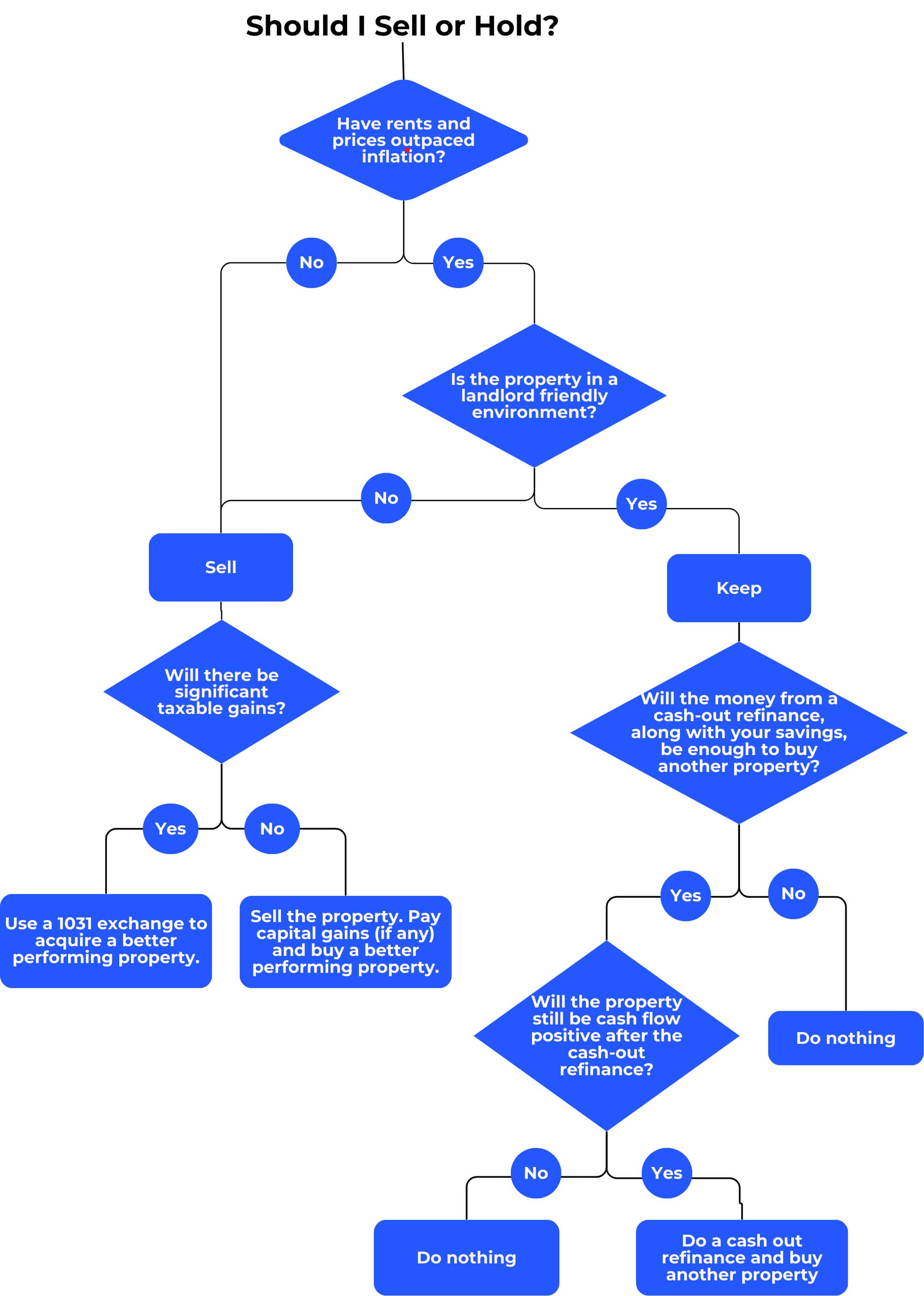

People often ask me, “Should I sell, refinance, do a 1031 exchange, or hold?” The answer depends on how the property has performed over time. Below is a simple way to think through the options and when each makes sense.

Expanding on the decision tree:

Replace the Property or Keep It?

Have rents and prices for this property outpaced inflation? If they haven’t, the property is slowly losing purchasing power—even if rents are increasing.

Replace the Property

If the property has not kept up with inflation, you need to replace it. You generally have two paths:

- 1031 Exchange (high equity)If you have significant equity, a 1031 exchange may make sense. It allows you to sell the property and defer capital gains taxes by reinvesting the proceeds into another investment property. See the following article for how we handle 1031 exchanges: A Safer 1031 Exchange Process

- Sell and Reinvest (low equity)If equity is limited, selling and reinvesting the proceeds into a better-performing property may be the simplest option. In many cases, taxes owed are minimal or zero.

Keep the Property

If the property has performed well over time and you have meaningful equity, a cash-out refinance is often the best option. Many investors refinance up to 75% loan-to-value and use the proceeds to purchase an additional property—allowing them to grow their portfolio without selling. Here is a case study showing how this works.

Summary

There is no single answer to “Sell, Refinance, 1031, or Hold.” Every decision starts with one question: Have rents and prices outpaced inflation? Long-term performance is defined by the city, not the property. If rents aren’t rising faster than inflation, no individual property can fix that. In that case, the right move is to replace the property with one in a city where rents and prices consistently outpace inflation.